Spreds 2A

€4,750,001

total amount raised in round

- Backed by over 440 investors

This campaign has been closed

To better our world by supporting entrepreneurship - that is the goal of MyMicroInvest in the development of our economy.

— Olivier de Duve, CEO of MyMicroInvest S.A.

MyMicroInvest was started in Belgium, a small economy in the heart of Europe and very open to entrepreneurship. In line with the average for the EU, SMEs have dominated the Belgian economic landscape in recent years (2011-2014), representing over 60% of the added value and over 69% of employment.

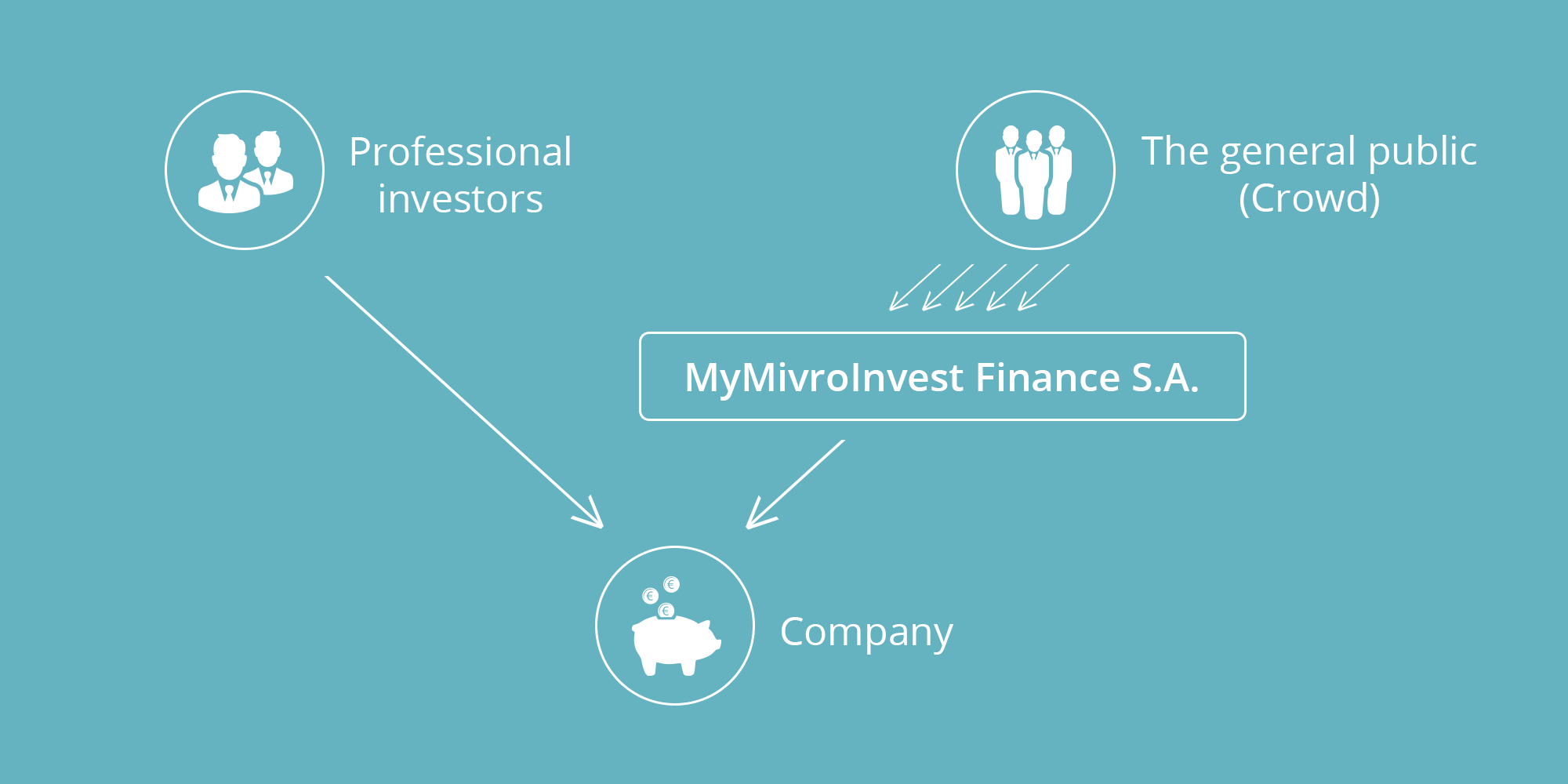

Created by entrepreneurs, MyMicroInvest intends to shake up the finance world. How? By connecting entrepreneurs seeking financing to professional investors and the public at large (Crowd).

Why? Because at MyMicroInvest, we are convinced that “unity makes strength.”

Why? Because at MyMicroInvest, we are convinced that “unity makes strength.”

In July 2015, MyMicroInvest saw a capital increase of around 3 million euros, 753,000 EUR of which were the result of a conversion of a loan granted by its administrators, and 2,250,000 EUR of which were raised from private investors. Now, at the start of 2016, our team wants to offer you the possibility of investing in its capital under the same financial conditions as those granted to private investors in July 2015.

You too can support and invest in tomorrow’s economy! For more information regarding the type of investment mentioned in this section, please read the Prospectus carefully before subscribing to the Notes, and in particular, consider the risk factors it describes before making any decision on investment.

You too can support and invest in tomorrow’s economy! For more information regarding the type of investment mentioned in this section, please read the Prospectus carefully before subscribing to the Notes, and in particular, consider the risk factors it describes before making any decision on investment.

What is MyMicroInvest exactly?

MyMicroInvest is made up of 3 main activities that allow entrepreneurs seeking financing to connect with professional investors and the public at large:

MyMicroInvest is made up of 3 main activities that allow entrepreneurs seeking financing to connect with professional investors and the public at large:

1. An equity and debt crowdfunding platform

MyMicroInvest operates a crowdfunding platform that allows the public at large to invest in the equity of innovative companies alongside the professionals, or loans in the case of more mature companies.

Technically, crowdfunding at MyMicroInvest is unique in that:

MyMicroInvest operates a crowdfunding platform that allows the public at large to invest in the equity of innovative companies alongside the professionals, or loans in the case of more mature companies.

Technically, crowdfunding at MyMicroInvest is unique in that:

- Its investment vehicle: MyMicroInvest Finance S.A.

MyMicroInvest Finance is the heart of its crowdfunding activity. This investment vehicle is very popular amongst entrepreneurs and investors. On the one hand it allows the interests of small investors to come together under a single structure, whilst on the other hand providing entrepreneurs with one sole intermediary (MyMicroInvest Finance S.A. becomes the shareholder or lender in the company financed).

MyMicroInvest Finance is the heart of its crowdfunding activity. This investment vehicle is very popular amongst entrepreneurs and investors. On the one hand it allows the interests of small investors to come together under a single structure, whilst on the other hand providing entrepreneurs with one sole intermediary (MyMicroInvest Finance S.A. becomes the shareholder or lender in the company financed).

- Has the capacity to raise millions of euros throughout Europe.

MyMicroInvest regularly executes Initial Public Offerings by depositing a prospectus with the FSMA. This allows MyMicroInvest to finance large-scale business projects with no limit as to the amount.

With its investment vehicle, MyMicroInvest intends to execute cross-border transactions allowing companies to make Initial Public Offerings in all 28 EU countries.

With its investment vehicle, MyMicroInvest intends to execute cross-border transactions allowing companies to make Initial Public Offerings in all 28 EU countries.

- Its crowdfunding expertise

MyMicroInvest is not a bank. This young company is independent and responsive. Its strength lies in its close relationship with entrepreneurs and investors. Crowdfunding is an occupation in its own right and the majority of the 20 members of the MyMicroInvest team solely work in this area.

MyMicroInvest is not a bank. This young company is independent and responsive. Its strength lies in its close relationship with entrepreneurs and investors. Crowdfunding is an occupation in its own right and the majority of the 20 members of the MyMicroInvest team solely work in this area.

- The diversity of investment opportunities

MyMicroInvest offers its members the possibility to invest, through MyMicroInvest Finance, both in equity and in debt (for more mature companies).

This diversity likewise offers investors the chance to diversify their investment portfolio.

- Live Crowdfunding Events

MyMicroInvest, together with its various partners (BNP Paribas Fortis or Keytrade Bank), regularly organises large-scale events in grand venues such as the Chancellerie Building at BNP, Tour et Taxis, the Liege National Theatre, etc.

MyMicroInvest offers its members the possibility to invest, through MyMicroInvest Finance, both in equity and in debt (for more mature companies).

This diversity likewise offers investors the chance to diversify their investment portfolio.

- Live Crowdfunding Events

MyMicroInvest, together with its various partners (BNP Paribas Fortis or Keytrade Bank), regularly organises large-scale events in grand venues such as the Chancellerie Building at BNP, Tour et Taxis, the Liege National Theatre, etc.

MyMicroInvest has a strong focus on the industrialisation of its procedures.

Such is the case, for example, in the production of the information for investors, and, in particular, the prospectuses that are produced at very low cost (the document submitted to the financial authority in the event of an Initial Public Offering).

Such is the case, for example, in the production of the information for investors, and, in particular, the prospectuses that are produced at very low cost (the document submitted to the financial authority in the event of an Initial Public Offering).

MyMicroInvest focuses on financing for three commercial enterprise segments:

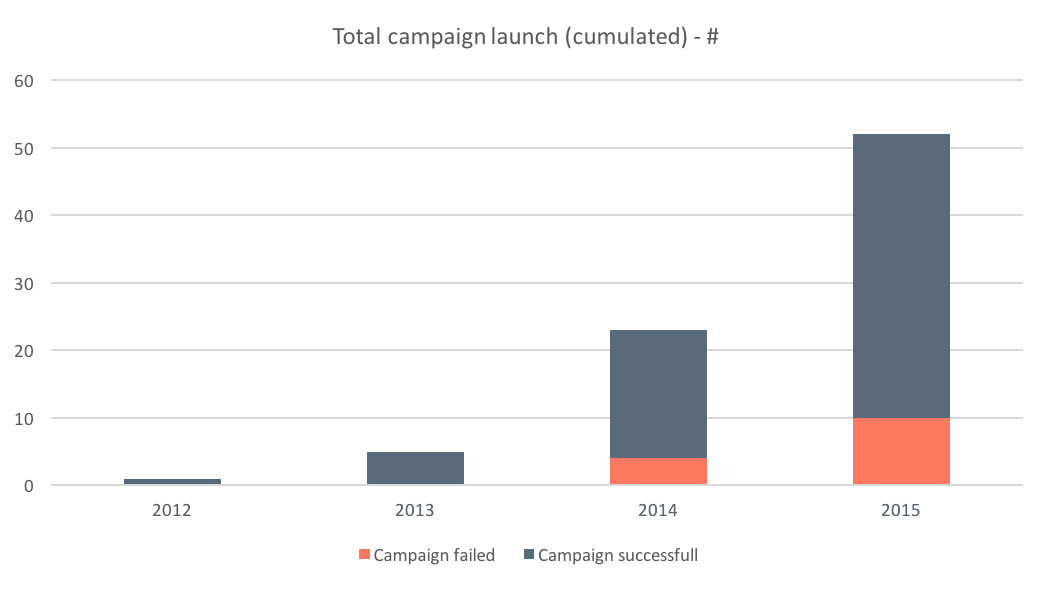

MyMicroInvest is a company in full expansion.

To date, MyMicroInvest has received applications from over 4,000 companies and launched over 50 crowdfunding campaigns.

To date, MyMicroInvest has received applications from over 4,000 companies and launched over 50 crowdfunding campaigns.

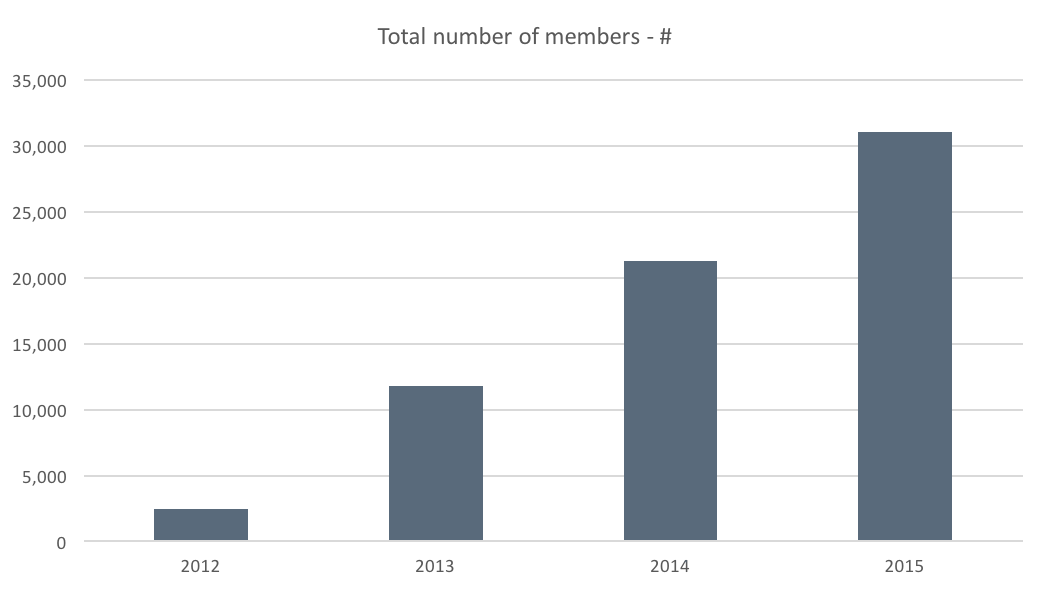

The MyMicroInvest community has been increasing from year to year and had over 30,000 members at the end of 2015.

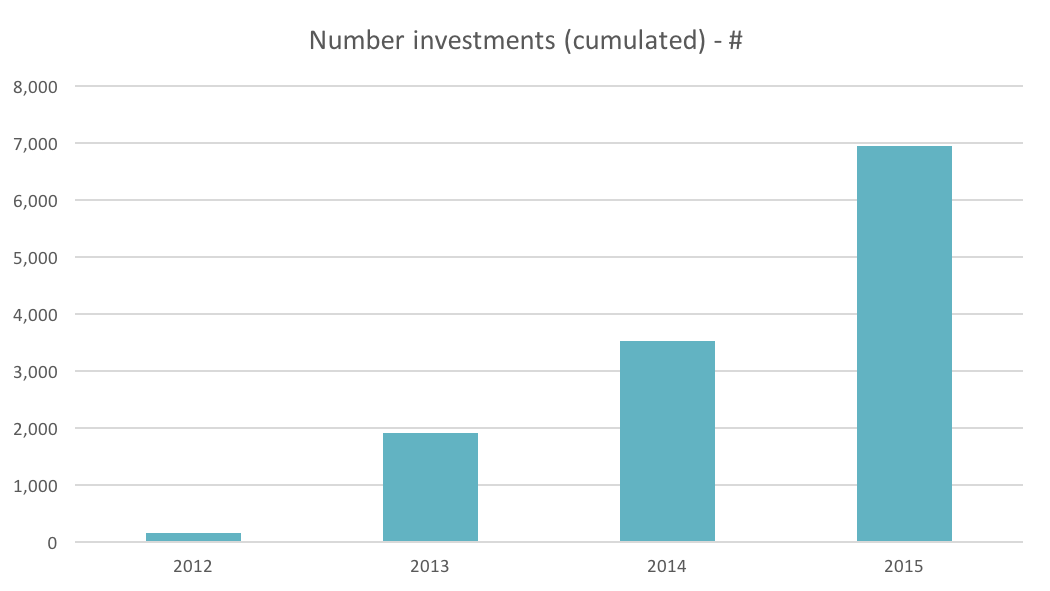

But the key lies in the exponential growth in the number of investments made on the platform.

2. Inventures' activity

MyMicroInvest also manages the Inventures investment vehicle.

Inventures is positioned in the impact investing ecosystem given that it holds shares (together with the mass public) in young companies that provide solutions to social problems.

Inventures is positioned in the impact investing ecosystem given that it holds shares (together with the mass public) in young companies that provide solutions to social problems.

In order to be closer to the clients in its portfolio, Inventures limits its investments to within 500km of Brussels.

Shareholdings are concentrated in the environmental, health, educational, social and economic sectors.

Inventures has raised around 15 million euros from private and institutional investors.

To date, 8.5 million euros have already been invested (or earmarked) in the eleven companies in the portfolio. Inventures will thus continue to invest in other companies throughout 2016.

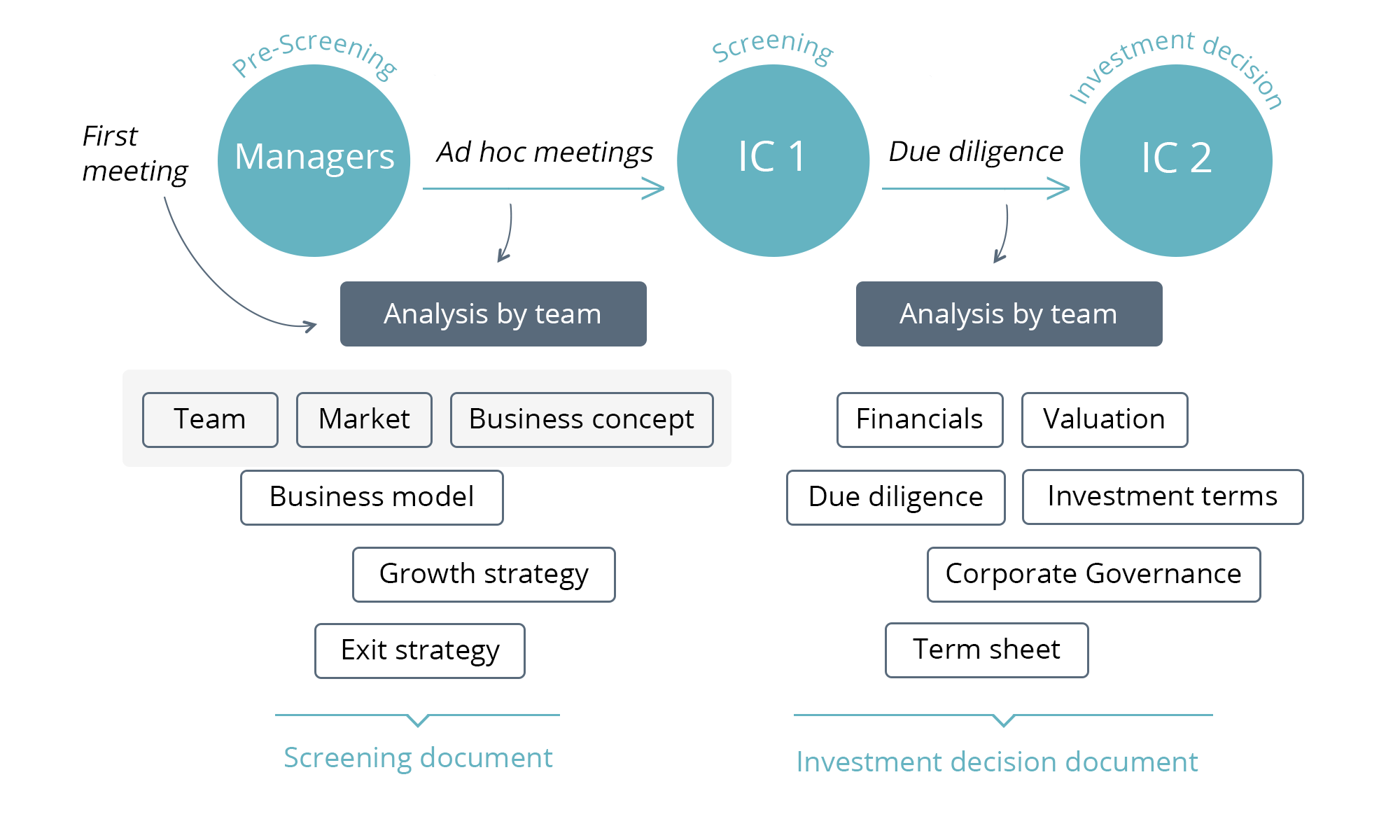

In line with the investment strategy of Inventures, MyMicroInvest has developed an investment process that increases the chances of success from the selection of companies to the resale of the shares.

At the heart of this process is the Investment Committee (IC) of Inventures. This Committee is made up of shareholder and management representatives but also private individuals.

3. Speedfunding Activity

MyMicroInvest also organises regular speedfunding events. These events allow entrepreneurs to come and present their projects and financing needs before the premium investors of the platform or other business angel-type investors wishing to invest at least 25,000 EUR, with the aim of establishing a first contact between the company and the candidates for direct investment in these companies.

To meet the demand of Business Angel members of MyMicroInvest, a new development strategy to allow premium and professional investors to invest directly online could be implemented during 2016.

This is in order to meet the growing need for business angels in our network.

Marketing strategy

A marketing strategy has been implemented by MyMicroInvest to strengthen its online presence in particular. Newsletters are sent weekly and online marketing is deployed through Google AdWords and Facebook. This provides greater visibility for the platform, the acquisition of new members, the conversion of members into investors, an increase in the investment rate and the average investment amount.

This visibility likewise attracts entrepreneurs.

An offline marketing strategy is also in place to increase the visibility of MyMicroInvest through events and exhibitions, printed leaflets, etc.

This visibility likewise attracts entrepreneurs.

An offline marketing strategy is also in place to increase the visibility of MyMicroInvest through events and exhibitions, printed leaflets, etc.

Distribution strategy

MyMicroInvest boasts a distribution system for all of its activities:

a) Online: At www.mymicroinvest.com. This channel allows the acquisition of entrepreneurs, professional investors and investors from the general public.

b) Offline: Via its partners, different key players in the entrepreneurial ecosystem, and various events. This channel allows the acquisition of entrepreneurs and professional investors.

a) Online: At www.mymicroinvest.com. This channel allows the acquisition of entrepreneurs, professional investors and investors from the general public.

b) Offline: Via its partners, different key players in the entrepreneurial ecosystem, and various events. This channel allows the acquisition of entrepreneurs and professional investors.

Major contracts

MyMicroInvest has entered into several key contracts:

- An administration agreement with MyMicroInvest Finance S.A.;

- A partnership agreement with BNP Paribas Fortis;

- A partnership agreement with Keytrade Bank;

- A partnership with Optiva Darna (an intermediation structure that brings together Chinese investors wishing to invest in Europe and European investors wishing to invest in China);

- A partnership agreement with Polish SpeedUp Innovation Fund.

- A partnership agreement with BNP Paribas Fortis;

- A partnership agreement with Keytrade Bank;

- A partnership with Optiva Darna (an intermediation structure that brings together Chinese investors wishing to invest in Europe and European investors wishing to invest in China);

- A partnership agreement with Polish SpeedUp Innovation Fund.

Main partners

MyMicroInvest is proud to work with such high quality and added value partners.

The partnership strategy set up by MyMicroInvest is simple:

The partnership strategy set up by MyMicroInvest is simple:

- Partners for Project Sourcing

To date, MyMicroInvest has signed a significant partnership agreements with BNP Paribas Fortis.

Moreover, the MyMicroInvest action is integrated into the Belgian entrepreneurial ecosystem. Thus, MyMicroInvest has the chance to work closely with numerous operators (local public funds, business incubators and accelerators) of this ecosystem.

To date, MyMicroInvest has signed a significant partnership agreements with BNP Paribas Fortis.

Moreover, the MyMicroInvest action is integrated into the Belgian entrepreneurial ecosystem. Thus, MyMicroInvest has the chance to work closely with numerous operators (local public funds, business incubators and accelerators) of this ecosystem.

- Partners for campaign distribution

MyMicroInvest signed a partnership agreement with the online bank “Keytrade Bank”. Now, Keytrade Bank offers its investors a new type of asset by allowing them to invest in crowdfunding campaigns on MyMicroInvest.com.

MyMicroInvest signed a partnership agreement with the online bank “Keytrade Bank”. Now, Keytrade Bank offers its investors a new type of asset by allowing them to invest in crowdfunding campaigns on MyMicroInvest.com.

- International partners

MyMicroInvest intends to expand internationally by supporting local partners who are active in the risk capital market. The first partnership agreement was entered into with the Polish Speed-Up Ventures fund, which will be integrated into the file sourcing, selection and analysis process.

MyMicroInvest intends to expand internationally by supporting local partners who are active in the risk capital market. The first partnership agreement was entered into with the Polish Speed-Up Ventures fund, which will be integrated into the file sourcing, selection and analysis process.